Revenue share agreements between clients and agencies are becoming increasingly popular. In this article, we’ll explore what it is, what the benefits are, and how to create one.

First of all, what is it?

Instead of paying a fixed hourly or monthly fee, the client pays only a part of the revenue that the agency generates for them.

It sounds simple in theory. But in practice, measuring the revenue is difficult.

Marketing generates revenue in two ways: through short-term sales activation and long-term brand awareness. The short-term effects are smaller but easy enough to measure. The long-term effects are bigger but difficult to measure.

By giving a % of your revenue to an agency, two things will happen. First, you will pay the agency for revenue that they didn’t generate. Second, the agency will generate future revenue for which they won’t get paid.

That’s the messy reality of marketing. Precision is just not an option. But a revenue share model can still be useful even if it isn’t completely accurate.

- It reduces the risk for the client by turning the agency fee from a fixed to a variable cost.

- It aligns incentives and motivates the agency to work on things that actually generate revenue.

In other words, a revenue share deal can reduce risk and lead to better results. It doesn’t need to be 100% accurate. It just needs to work for both the client and the agency.

What does it look like in practice?

First, we must define what we mean by revenue. Should the agency only get a share of revenue that can be attributed to digital marketing, e.g. Google or Meta ads? This may seem like a good idea at first glance. But we recommend against it.

While attribution is a useful tool, it can’t differentiate between correlation and causation. Just because someone clicked on an ad before purchasing, doesn’t mean that the ad directly caused the purchase.

So using attribution as the basis for a revenue share model doesn’t necessarily make the model more accurate. But even worse, it can incentivize the agency to maximize marketing-attributed revenue, e.g. by focusing too much on branded search ads.

In some cases, it makes sense to only base it on part of the revenue. For example, if a business has clearly separated segments like B2B/B2C or online/offline. Otherwise, we recommend using total revenue as the basis.

What should the percentage be?

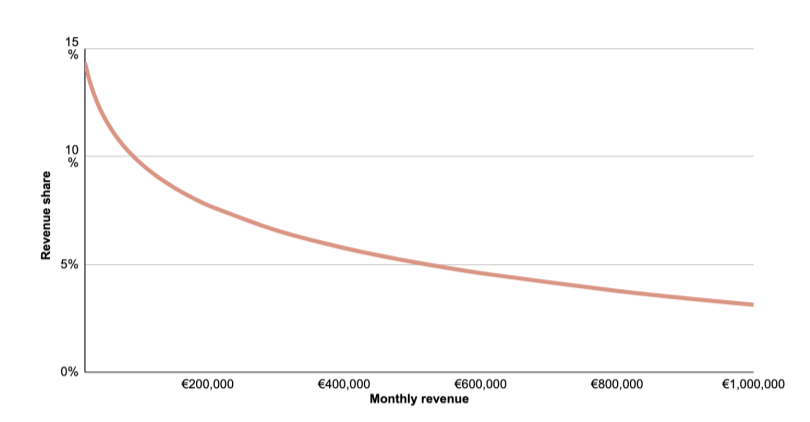

There is no correct answer. The percentage needs to take factors like size, maturity, margins, etc into consideration. We have deals ranging from 1% to 10%, depending on the client.

We always avoid using a fixed percentage. It’s simple but often unsustainable.

A better approach would be using a model where the percentage decreases exponentially as revenue increases. This incentivizes the agency to keep pushing for growth while keeping the fee manageable for the client.

Here is an example of such a model that we created for e-commerce brands.

The bottom line

Revenue share models are not perfect. They don’t work for all companies.

But when it’s used correctly, it can be incredibly beneficial for both the client and the agency.

Contact us if you’re interested in learning more!